Research report

Infrastructure Funding and Financing (Wellington Sludge Minimisation Facility Levy) Order 2023

Last updated: 10 August 2023 The Infrastructure Funding and Financing (Wellington Sludge Minimisation Facility Levy) Order 2023 is an Order in Council established under the Infrastructure Funding and Financing Act 2020 (IFF Act). Wellington is the second city to use the IFF Act to raise funding for much-needed infrastructure.

Te Tūāpapa Kura Kāinga – Ministry of Housing and Urban Development (HUD) is responsible for administering the Infrastructure Funding and Financing Act 2020, and also has the roles of ‘recommender’ and ‘monitor’ under the Act.

Overview

The Sludge Minimisation Facility Levy Order allows a special purpose vehicle (SPV), called Sludge Finance LP, to charge a levy to most rate-paying properties in Wellington City Council’s rating area for 33 years, from 1 July 2024.

This levy has enabled the SPV to raise $400 million from private financiers to reimburse Wellington City Council for the construction costs of a sludge minimisation facility in Wellington.

The SPV is a wholly owned subsidiary of Crown Infrastructure Partners and are a Crown-owned company, listed under Schedule 4A of the Public Finance Act 1989.

The SPV has raised its finance from Crown Infrastructure Partners, Accident Compensation Corporation, ANZ Bank New Zealand Limited, Commonwealth Bank of Australia, Industrial and Commercial Bank of China Limited, and China Construction Bank Corporation.

Raising finance to fund the sludge minimisation facility through the IFF Act model means the debt raised does not sit on Wellington City Council’s balance sheet. This allows the council to retain debt headroom for other projects without the need to increase rates and/or reduce capital expenditure.

The Sludge Minimisation Facility Levy Order can be found on the Legislation New Zealand website.

Wellington City Council's sludge minimisation facility

The sludge minimisation facility will be adjacent to the existing wastewater treatment plant at Moa Point. This facility will utilise chemical and mechanical processes to handle and dispose of wastewater sludge. It is intended to improve the stabilisation, and reduce the volume, of Wellington City’s wastewater sludge, reduce carbon emissions associated with the disposal of sludge at the Southern Landfill, and enable future economic and population growth via increased wastewater management capacity.

For more information on the sludge management facility, visit Wellington City Council’s webpage: Projects - Moa Point sludge minimisation facility - Wellington City Council(external link)

Leviable properties

The levy applies to all properties within the district in which Wellington City Council is entitled, at any time, to charge general or targeted rates under the Local Government (Rating) Act 2002 (Wellington City Council rating area), excluding protected Māori land. Levy remissions and postponement policies will be established by the SPV and Wellington City Council, but are expected to be similar to existing Wellington City Council rates remission and postponement policies.

If the boundaries of the Wellington City Council rating area are updated over time, the levy area will automatically update alongside it.

Categories of leviable land

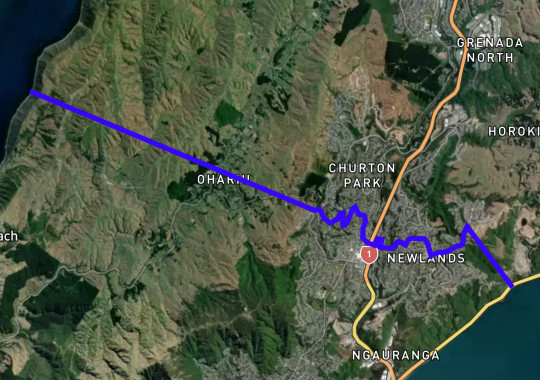

The levy applies differentially to properties that are expected to have their wastewater treated by the sludge minimisation facility and properties that will not be connected to the sludge minimisation facility. Properties in some of the northern part of Wellington (refer to the map below) typically have their wastewater treated by a facility in Porirua. Additionally, some properties are not connected to the wastewater network at all. Despite not being connected to the new sludge minimisation facility, these properties will still pay the levy, albeit at a lower rate.

Charging properties unconnected to the sludge minimisation facility a lower levy reflects that, while they are not directly using the new facility, they still receive some benefits from the facility, such as reduced waste and carbon emissions and increased capacity for growth.

Beneficiary group 1 (BG1)

BG1 includes properties that are expected to be connected to the sludge minimisation facility (once operational).

BG1 means a base (which includes residential) or commercial rating unit within the WCC rating area that, as at 30 June immediately preceding the levy year, is connected to the Wellington wastewater network and meets 1 or more of the following criteria:

1. it is south of the blue line shown in the map below,

2. its wastewater is treated at the Moa Point Treatment Plant or the Western Treatment Plant (Karori),

3. its wastewater is treated at the sludge minimisation facility.

Beneficiary group 2 (BG 2)

BG2 includes all rating units within WCC’s rating area. BG2 is inclusive of BG1, and as such a rating unit within BG1 will be charged both a BG1 and a BG2 portion of the levy.

Base and commercial properties

The levy will also apply differentially to base properties (which includes residential) and commercial properties. 75% of the levy will be charged to base properties and the remaining 25% will be charged to commercial properties.

Protected Māori land

Protected Māori land can only be included in a levy area with the written consent of the owners of the land. This consent must be provided in advance of the recommendation report being provided to the Minister of Housing.

Protected Māori land is defined in section 11 of the IFF Act(external link) and generally includes Māori freehold land and Māori customary land. However, it also applies to several other categories of land, including general title land owned by Māori if it was previously Māori freehold land, but had its status changed by Part 1 of the Maori Affairs Amendment Act 1967 or an order of the Māori Land Court made on or after 1 July 1993.

While there are some parcels of land in the Wellington City Council rating area that meet the definition of protected Māori land, there are no parcels of protected Māori land included in the levy area.

The Levy period

The levy will be charged for 33 years, from 1 July 2024 to 30 June 2057.

As noted below, the intended annual levy for the last three years of the levy period (2055-2057) is $0. However, levies could still be charged in these final years if levy collections for prior years are lower than the annual levy set for those years.

-

Maximum Levy revenue

The maximum amount of levy revenue that can be collected over the entire levy period is $1,241,166,366.55 plus GST (if any).

This amount may be reduced from time to time if the SPV’s forecast of its excess levy revenue exceeds $1 million (see below). Any reduction in the maximum levy revenue will be published here.

The maximum levy revenue was reduced by $30,278,426.45. as a result of the forecast at 1 October 2023.

-

Intended annual levy

The amount of levy revenue that the SPV intends to charge in each year of the levy period is detailed in the table below:

Levy year ending 30 June

Intended annual levy revenue (plus GST, if any)

2025

$7,634,303.11

2026

$15,405,356.19

2027

$23,683,696.91

2028

$31,747,558.88

2029

$31,885,221.58

2030

$32,597,099.22

2031

$32,737,254.12

2032

$33,084,851.44

2033

$34,955,327.91

2034

$35,252,725.84

2035

$35,537,716.84

2036

$38,043,999.34

2037

$38,390,190.94

2038

$38,707,341.02

2039

$41,470,222.15

2040

$41,901,300.93

2041

$42,281,010.85

2042

$45,308,967.43

2043

$45,681,828.43

2044

$46,025,471.22

2045

$49,194,316.79

2046

$49,588,149.19

2047

$49,948,660.47

2048

$53,409,614.02

2049

$53,867,331.93

2050

$54,342,239.50

2051

$58,083,273.45

2052

$58,501,112.22

2053

$58,921,956.66

2054

$62,978,268.37

2055

$0

2056

$0

2057

$0

The intended annual levy in the final three levy years is $0. However, levies could still be charged in these final years if levy collections for prior years are lower than the annual levy set for those year.

If the maximum levy revenue is reduced, corresponding amendments to the intended annual levy for the remainder of the levy period must also be made and the above table will be updated.

Eligible costs

The levy will enable the SPV to provide up to $400 million of funding towards the eligible costs of Wellington City Council’s sludge minimisation facility.

Levy revenue may be applied towards the following types of eligible costs:

- the costs of constructing the eligible infrastructure, including establishment costs;

- the financing costs such as interest and fees, debt repayment and equity return;

- the cost of administering the levy;

- general operating costs of the SPV; and

- any further costs of the SPV in complying with the IFF Act or the proposed levy order.

Eligible infrastructure

The eligible infrastructure to which the levy applies is:

- the sludge minimisation facility which is to be located at Moa Point, Wellington (adjacent to the wastewater treatment plant that exists on the commencement of the Order) that is to be built to utilise chemical and mechanical processes to handle and dispose of wastewater sludge (with a view to improving the stabilisation of, and reducing the volume of, wastewater sludge).

- Works in relation to the following, to the extent that those works are necessary or desirable in connection with the construction of the sludge minimisation facility:

- the Moa Point Treatment Plant and other wastewater infrastructure in the vicinity of Moa Point;

- the existing sludge pipeline;

- the Carey’s Gully dewatering facility; and

- the Western Treatment Plant (Karori).

Setting Annual Levy

The annual levy is the amount of levy the SPV intends to collect in a given levy year. Before the start of each year in the levy period, the SPV must set the annual levy for the upcoming levy year by:

- Taking the intended annual levy for that year and

- Adding the annual reconciliation amount for the prior levy year.

The annual reconciliation amount for a levy year will be calculated with the following steps:

- Start with the annual levy for the year being reconciled.

- Subtract the amount of levy assessed to date in the year being reconciled.

- Subtract any increases in levy assessments for prior levy years determined after the previous annual reconciliation was undertaken.

- Add any decreases in levy assessments for prior levy years determined after the previous annual reconciliation was undertaken.

- Add any bad debts that have not been added to a prior reconciliation.

- Subtract any bad debts that were added to a prior reconciliation to the extent that those bad debts were subsequently paid.

The annual reconciliation for a levy year must occur before the SPV sets the annual levy for the next year. The annual levy for a levy year must be confirmed by 10 May before the start of the levy year.

As such, there may be changes to the amount of levy assessed for a levy year after the reconciliation for that year has been completed (for example, because of an objection raised by a levypayer as to the amount of levy for which they have been assessed that is not resolved at the time the reconciliation is completed).

Steps 3 and 4 above ensure these changes to the amount of levy assessed after the reconciliation will be taken into account in a later reconciliation.

-

Example – annual levy setting process

In setting the annual levy for 2028/29 levy year, the SPV must start with the intended annual levy for that year ($32,663,066 plus GST) and add the annual reconciliation amount for the previous levy year (2027/28) as detailed below:

- The intended annual levy for the 2027/28 levy year is $32,522,045, plus GST.

- At the time of reconciliation, a levy of $31,000,000 plus GST has been assessed.

- After the completion of the last annual reconciliation (for the 2026/27 levy year), a $300,000 plus GST increase in levy assessments (under section 68 of the Act) was determined for prior levy years.

- A total of $500,000 plus GST was categorised as bad debts during the 2027/28 levy year and $100,000 plus GST of bad debts that were added to a prior reconciliation were subsequently paid.

- The reconciliation amount for the 2027/28 levy year is therefore $1,622,045.

- This is calculated as $32,522,045 - $31,000,000 - $300,000 + $500,000 - $100,000.

The annual levy for the 2028/29 levy year is therefore $34,285,111 plus GST.

- This is calculated as $32,663,066 (the 2028/29 intended annual levy) + $1,622,045 (the 2027/28 annual reconciliation amount).

Assessing levy liability for individual properties

-

Residential properties connected to the sludge minimisation facility

An individual residential property that is connected to the sludge minimisation facility will be within both BG1 and BG2 and will be classified as a 'base' property. As such, to calculate the property’s annual levy liability, both the BG1 and BG2 levy amounts for that property must be calculated using the formulas below and then added together.

Total BG1 Levy = Annual Levy x 0.7

Total BG2 Levy = Annual Levy x 0.3

BG1 Levy liability = Total BG1 Levy x 0.75 x 0.75 x CV of property

Total CV of all BG1 (Base) rating units+ Total BG1 Levy x 0.75 x 0.25

Number of BG1 (Base) rating unitsBG2 levy liability = Total BG2 Levy x 0.75 x 0.75 x CV of property

Total CV of all BG2 (Base) rating units+ Total BG2 Levy x 0.75 x 0.25

Number of BG2 (Base) rating unitsExample

A residential rating unit has a capital value of $1m and is connected to the sludge minimisation facility. It is therefore within both BG1 and BG2.

The annual levy for the 2028/29 levy year is $32,522,045 (plus GST). This is multiplied by 0.7 to determine the total BG1 levy of $22,765,432 and multiplied by 0.3 to determine the total BG2 levy of $9,756,614.

For the purposes of this example, the total capital value of all BG1 (Base) rating units is assumed to be $87 billion and there are assumed to be 63,000 BG1 (Base) rating units.

The rating unit’s BG1 levy liability is $215. This is calculated as:

$22,765,432 x 0.75 x $1 million

$87 billion+ $22,765,432 x 0.75 x0.25

63,000= $215 For the purposes of this example, the total capital value of all BG2 (Base) rating units is assumed to be $105 billion and there are assumed to be 80,000 BG2 (Base) rating units.

The rating unit’s BG2 levy liability is $75. This is calculated as:

$9,756,614 x 0.75 x 0.75 x $1 million

$105 billion+ $9,756,614 x 0.75 x 0.25

80,000= $75 Therefore, the total levy liability for the rating unit in the 2028/29 levy year is $290 ($215+$75), plus GST.

-

Commercial properties connected to the sludge minimisation facility

An individual commercial property that is connected to the sludge minimisation facility will be within both BG1 and BG2. As such, to calculate the property’s annual levy liability, both the BG1 and BG2 levy amounts for that property must be calculated using the formulas below and then added together.

Total BG1 levy = Annual levy x 0.7

Total BG2 levy = Annual levy x 0.3

BG1 levy liability = Total BG1 Levy x 025 x CV of property

Total CV of all BG1 (Commercial) rating unitsBG2 levy liability = Total BG2 Levy x 025 x CV of property

Total CV of all BG2 (Commercial) rating unitsTotal levy liability = BG1 levy liability + BG2 levy liability

Example

A commercial rating unit has a capital value of $1m and is connected to the sludge minimisation facility. It is therefore within both BG1 and BG2.

The annual levy for the 2028/29 levy year is $32,522,045 (plus GST). This is multiplied by 0.7 to determine the total BG1 levy of $22,765,432 and multiplied by 0.3 to determine the total BG2 levy of $9,756,614.

For the purposes of this example, the total capital value of all BG1 (Commercial) rating units is assumed to be $18 billion.

The rating unit’s BG1 levy liability is $316. This is calculated as:

$22,765,432 x o.25 x $1 million

$18 billion= $316 For the purposes of this example, the total capital value of all BG2 (Commercial) rating units is assumed to be $22 billion.

The rating unit’s BG2 levy liability is $111. This is calculated as:

$9,756,614 x o.25 x $1 million

$22billion= $111 Therefore, the total levy liability for the rating unit in the 2028/29 levy year is $427 ($316+$111), plus GST.

-

Residential properties not connected to the sludge minimisation facility

An individual residential property that is not connected to the sludge minimisation facility will typically be outside of BG1 and will be classified as a 'base' property. As such, the property will only need to pay the BG2 component of the levy as calculated using the formulas below.

Total BG2 Levy = Annual Levy x 0.3

Levy Liability = Total BG2 Levy x 0.75 x 0.75 x CV of property

Total CV of all BG2 (Base rating units)+ Total BG2 Levy x 0.75 x 0.25

Number of BG2 (Base rating units)Example

A residential rating unit has a capital value of $1m and is not connected to the sludge minimisation facility. It is therefore outside BG1 and within BG2. As such, the property will only need to pay the BG2 component of the levy.

The annual levy for the 2028/29 levy year is $32,522,045 (plus GST). This is multiplied by 0.3 to determine the total BG2 levy of $9,756,614.

For the purposes of this example, the total capital value of all BG2 (Base) rating units is assumed to be $105 billion and there are assumed to be 80,000 BG2 (Base) rating units.

The rating unit’s total levy liability for the 2028/29 levy year is $75 plus GST. This is calculated as:

$9,756,614 x 0.75 x 0.75 x $1 million

$105 billion+ $9756,614 x 0.75 x 0.25

80,000= $75 -

Commercial units not connected to the sludge minimisation facility

An individual commercial property that is not connected to the sludge minimisation facility will typically be outside of BG1. As such, the property will only need to pay the BG2 component of the levy as calculated using the formulas below.

Total BG2 Levy = Annual Levy x 0.3

Levy Liability = Total BG2 Levy x 0.25 x CV of property

Total CV of all BG2 (Base) rating unitsExample

A commercial rating unit has a capital value of $1 million and is not connected to the sludge minimisation facility. It is therefore not part of BG1, but included in BG2. As such, the property will only need to pay the BG2 component of the levy.

The annual levy for the 2028/29 levy year is $32,522,045 (plus GST). This is multiplied by 0.3 to determine the total BG2 levy of $9,756,614.

For the purposes of this example, the total capital value of all BG2 (Commercial) rating units is assumed to be $22 billion.

The rating unit’s total levy liability for the 2028/29 levy year is $111 plus GST. This is calculated as:

$9,756,614 x 0.25 x $1 million

$22 billion= $111

For the purposes of the above formulas:

- Rating unit includes any part of a rating unit with the applicable categorisation

- The aggregate capital values of base and commercial rating units respectively are estimates of the aggregate capital values as at the start of the respective levy year.

- The aggregate capital values of base and commercial rating units respectively exclude any rating units to the extent levy remission applies.

Collecting the levy

The levy liability for a property will be included in the rates invoice issued by Wellington City Council for that property, and levies will be paid to the Council alongside rates. Wellington City Council will pass on the levy revenue it collects to the SPV.

Levy remission and postponement

The SPV’s policies for levy remission and postponement are published here:

Levy remission policy (PDF, 448 KB)

Levy postponement policy (PDF, 196 KB)

Annual levy resolutions

Each annual levy resolution contains the information necessary for Wellington City Council to correctly assess the amount each rating unit should be charged during the levy year, and the total amount of levy revenue that the SPV intends to collect in the levy year.

The annual levy resolutions for this levy will be published here no later than the May before the start of the levy year to which the resolution relates.

2025/26 Annual levy resolution (PDF, 1.3 MB)

2024/25 Annual levy resolution (PDF, 955 KB)

Annual Reports

Sludge Finance LP’s annual reports will be published here once available.

Forecast excess levy

Excess levy is levy revenue that, at the end of the levy period, has not been applied to eligible costs. The SPV will estimate the first forecast excess levy prior to the first levy year and subsequently, the SPV is required to periodically forecast its excess levy. The first forecast was completed as at 1 October 2023. Future forecasts will occur on the first 31 December after the completion and commissioning of the sludge minimisation facility, and at least every subsequent 31 December thereafter.

To calculate its forecast excess levy, the SPV will add its cash balances to its forecast of the expected levy revenue over the remaining levy period and its forecast of the expected drawdowns of debt and equity funding over the remaining levy period, and subtract its forecast of the expected eligible costs over the remaining levy period.

Forecast excess levy - 1 October 2023 (PDF, 418 KB)

Reduction in maximum levy revenue

If at any time the forecast excess levy is greater than $1 million (excluding GST), the SPV will be required to reduce the maximum levy revenue to ensure the forecast excess levy no longer exceeds $1 million. In addition, the SPV will be required to make corresponding amendments to the intended annual levy revenue for the remainder of the levy period.

The reduced intended annual levy revenue would be used for setting the annual levy for levy years beginning after the reduction occurs.

Reductions in maximum levy revenue could occur if, for example, the SPV’s financing costs decrease, or construction costs for the sludge minimisation facility are lower than anticipated.

The Special Purpose Vehicle

Sludge Finance LP is the responsible SPV for the purposes of the Sludge Minimisation Facility Levy Order. This SPV is a wholly owned subsidiary of Crown Infrastructure Partners. Sludge Finance LP is entitled to the levy that is collected under this order but is not responsible for the construction of the sludge minimisation facility.

Crown Infrastructure Partners is unable to sell its equity in the SPV unless consented to in writing by HUD as the IFF Act monitor. If it does so, HUD will be able to direct the SPV to not pay distributions to the new equity holders. However, certain rights of financiers (for example, the right to appoint a receiver, a receiver and manager, an administrator, or a liquidator to the SPV, or to acquire the partnership interests in the SPV and shares in its general partner) will be provided for without requiring HUD’s consent.

Limits on return of capital

The Levy Order limits the returns on capital that the owners of the SPV may receive. The SPV is required to ensure that the cumulative net equity cashflow in each year does not exceed the equity cashflow cap for that year.

The cumulative net equity cashflow is calculated by subtracting capital injections in the SPV from the payments made by the SPV to its owners.

The equity cashflow cap is calculated by following these steps:

- For the relevant levy year and each preceding levy year, calculating the lower of:

- The amount of unpaid levy for the year; or

- 5% of the annual levy for the year.

- Summing the lower amounts calculated in Step 1 and adding the total amounts of penalties and interest imposed and recovered from levy payers since the first levy year (less the costs of recovery).

- Subtracting the amount calculated in Step 2 from the amount specified for the relevant levy year in the below table.

-

Return on Capital Limits

Period

Limit ($)

31 July 2023 to 30 June 2024

(8,611,108)

Levy year ending 30 June 2025

(8,611,108)

Levy year ending 30 June 2026

(8,203,978)

Levy year ending 30 June 2027

(7,785,468)

Levy year ending 30 June 2028

(7,224,463)

Levy year ending 30 June 2029

(6,661,025)

Levy year ending 30 June 2030

(6,085,007)

Levy year ending 30 June 2031

(5,506,513)

Levy year ending 30 June 2032

(4,921,877)

Levy year ending 30 June 2033

(4,304,188)

Levy year ending 30 June 2034

(3,681,243)

Levy year ending 30 June 2035

(3,053,263)

Levy year ending 30 June 2036

(2,380,994)

Levy year ending 30 June 2037

(1,702,608)

Levy year ending 30 June 2038

(1,018,618)

Levy year ending 30 June 2039

(285,805)

Levy year ending 30 June 2040

454,625

Levy year ending 30 June 2041

1,201,765

Levy year ending 30 June 2042

2,002,411

Levy year ending 30 June 2043

2,809,646

Levy year ending 30 June 2044

3,622,954

Levy year ending 30 June 2045

4,492,258

Levy year ending 30 June 2046

5,368,521

Levy year ending 30 June 2047

6,251,154

Levy year ending 30 June 2048

7,194,946

Levy year ending 30 June 2049

8,146,826

Levy year ending 30 June 2050

9,107,097

Levy year ending 30 June 2051

10,133,476

Levy year ending 30 June 2052

11,167,239

Levy year ending 30 June 2053

12,208,438

Levy year ending 30 June 2054

43,808,182

Levy year ending 30 June 2055

45,479,433

Levy year ending 30 June 2056

45,479,433

Levy year ending 30 June 2057

45,479,433

1 July 2057 and following

45,479,433